Since the pandemic, it seems the whole world has gone sideways……used cars are almost as costly as new cars, new cars have 3 year wait lists, online purchases take forever and a day to arrive, gas and food costs are up (have you bought grapes lately???) are and now interest rates have pushed home financing costs to the threshold of many homeowners.

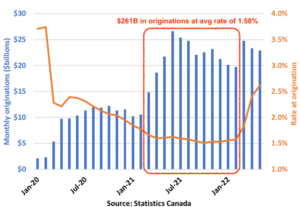

According to the Bank of Canada “Nearly three in every 10 homeowners with a mortgage had a variable interest rate at the end of 2021. Of those, four out of five had fixed payments.” I’ve heard it suggested, that’s around 750,000 mortgages. In an August Tweet, Ben Rabidoux, a prominent housing market analyst reported that $260B worth of variable rate mortgages were originated between March 2021 and February 2022 at an avg rate of 1.58% The Royal Bank of Canada reported in August during the company’s earnings call that approximately 80,000 variable-rate mortgage holders will hit their trigger rate in the “next couple of rate hikes.” That’s a lot of people! If you’re a homeowner, you NEED to check your mortgage to see what kind of mortgage you have, what your payments are, and when your renewal date is. You’re too young to have heart failure when the bank sends you THAT letter! Be proactive, be prepared!

Monthly Variable Rate Mortgage Originations

The “trigger rate” is when the prime rate rises to the point where your personal scheduled mortgage payments are only paying interest and not principal. This is not allowed under Canadian lending rules. At this point you would need to either increase your regular payments or convert to a fixed rate mortgage.

The “trigger point” is when the outstanding principal amount exceeds the original principal amount. At this point, a homeowner has 3 basic options if they can’t or don’t want to refinance and extend their amortization (which would result in pre-payment penalties):

- Make a lump-sum payment against the loan amount

- Convert with a new loan at a fixed-rate term

- Increase the monthly payment amount to pay off the outstanding principal balance within the remaining original amortization period.

If you are fortunate enough to have multiple properties, some of which you own free and clear, then there may be other creative ways to manage your finances, but that’s a story for another day and another cup of coffee….

Don’t be ambivalent. Every lender has a different course of action when it comes to determining what happens when you hit your trigger rate. Go today and pull your mortgage paperwork out, go online or call your lender to check what your current payments are, and how they deal with trigger rate/point, and at least know where you stand. It might not be great news, but at least you’ll be in a position to explore the options your circumstances offer before the bank is breathing down your neck.

Have questions or want help interpreting your mortgage paperwork? Text, call, email me. If you’re feeling kinda shy, just go ahead and download my handy app at https://dlcapp.ca/app/darla-nicholson/download and do some exploring yourself before reaching out. Even easier, scan this QR to go directly to the app!