What do you think about reverse mortgages, now more commonly referred to as Home Equity Conversion Mortgages (HECMs)? Do you believe you understand how they work? I’m willing to bet if you read this article you will find you very much misunderstood this product.

Reverse mortgages are the single fastest growing home finance product on the market right now. Reverse mortgages have a $2b share in the home finance market and we anticipate strong growth to $10m quickly over the next few years as a result of our challenging financial environment. Why?

- The need for a product that allows aging folks to access their hard-earned cash from the equity in their homes without having to qualify based on income.

- British Columbia, particularly areas like Vancouver and the surrounding regions, has experienced significant increases in home prices over the years. This has contributed to the attractiveness of reverse mortgages for homeowners looking to tap into their home equity.

- Government Regulations: The reverse mortgage market in Canada is regulated by the federal government, with specific guidelines in place to protect consumers. Borrowers are required to undergo mandatory counseling to ensure they understand the terms and implications of a reverse mortgage.

- Consumer Awareness: Efforts to educate consumers about reverse mortgages have increased, including information about the risks and benefits associated with these products. Many financial institutions and mortgage lenders offer reverse mortgages in British Columbia, contributing to consumer awareness and accessibility.

Here’s some food for thought based on the FACTS…. (using HomeEquity Bank and it’s products for the purposes of this article)

A reverse mortgage is just a first charge on your property. You still own your home and have title to the home. However, it is different from all other types of loans in a couple ways.

- Any other type of loan requires that you qualify for the loan based on income and credit.

- All other loans require that you make a monthly payment until the debt is paid off.

Because of the stress test, qualifying for financing is difficult for many, and making a payment is counterintuitive if improving cash flow is the goal.

So, instead of having to qualify for a loan based on income and credit, it’s mainly age and equity that determines the approval for a reverse mortgage. The older the client, the higher the approved limit you receive…the younger the client, the lower the limit. Essentially, you are given a credit limit on the home, the money can be used for whatever you like, but you never have to make a single payment against it for as long as one applicant lives in the home. Instead of a regular loan where you make a payment every month, with a reverse mortgage the interest that they charge is simply added to your balance and grows over time. Whenever you eventually sell the home, that is when they are paid back the money you borrowed plus the interest that accrued over the years; the rest of the equity is all yours.

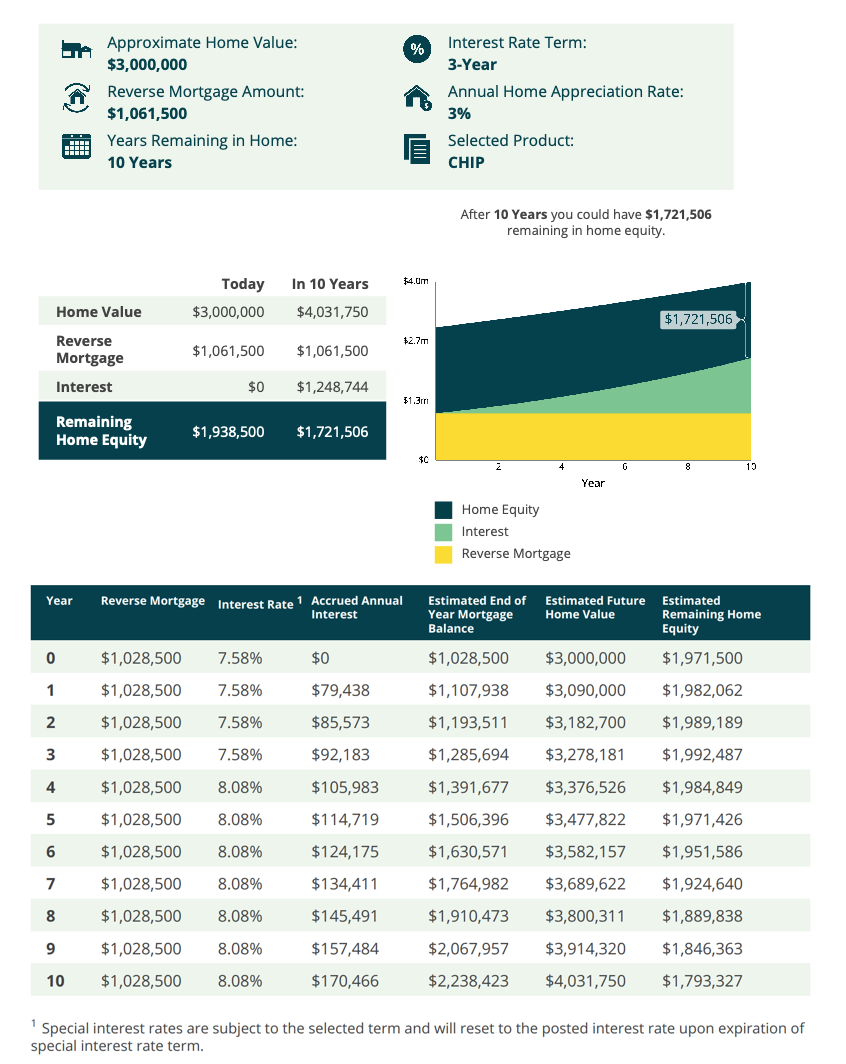

History has shown that while the balance owing increases over time because of the accruing interest, the home tends to appreciate over time as well. Typically, clients find that they have just as much equity left in the home when they sell as when they started, because the appreciation on the home made up for the accruing interest. To provide clients further confidence, HomeEquity Bank has a “fair market value guarantee”….this means that if you ever sell the home at fair market value, and you owe more than it sells for, HomeEquity Bank takes the loss; not you. Here is an example of what a reverse mortgage could look like on a $3m home for a 68 year old applicant that intends to stay in his home for 10 years (of course you can get out of the reverse mortgage prior to the 10 years if you wanted to – see below about possible applicable penalties).

Comparing Home Equity to RRSP’s

When you really think about it, your house is an investment you made; not too different from RRSP’s. You paid a mortgage payment every month for 25 years into an investment, and now it represents $1m of your life savings. Had you put money into an RRSP for 25 years and you had $1m in that account, you would likely be drawing down on that investment to help fund your retirement. In the end, there would be less money in the RRSP because you chose to use some of the money along the way. There is a cost to spending RRSP’s, though….first, when you take money from an RRSP, you are no longer earning interest on that money, so it’s costing you 5%-6% in lost returns when you take it out. Plus, the money is taxable income. When you take money out of the savings account in your home, they will charge you interest, but that’s no different than the interest you lose when taking from investments. The money from your home is tax free, and the value of the asset doesn’t deplete just because you used some of the money. As well, proceeds from a reverse mortgage are typically not considered taxable income and do not affect eligibility for government benefits such as Old Age Security (OAS) or Guaranteed Income Supplement (GIS).

Penalties

A common misunderstanding is that if clients take a short term, they can pay it out at the end of the term with no penalty. A reverse mortgage becomes that way after 5 years, but in the first 5 years, regardless of the term chosen, the prepayment penalties to pay it off are as follows:

0-12 months – penalty is 5% of the balance owing

13-24 months – penalty is 4% of the balance owing

25-36 months – penalty is 3% of the balance owing

After 3 years – penalty is 3 months interest

Penalty always waived upon death of the last applicant

Penalty reduced by 50% if moving into a care facility

At the 5 year mark, now clients can start paying off at the end of each term with no penalty; otherwise it just stays at 3 months interest

There are a number of products available within HomeEquity Bank for you to choose from. I am attaching a comparison sheet for you to look over. There is a fully open product where the above penalties DON’T apply. That product costs a little more to set up (upfront fee is the greater of $2995 or 1.25% of the loan amount), and the rate is Prime+3.54%, but that is less expensive than paying the penalties to get out of the regular CHIP in the first couple years.

Who is a reverse mortgage useful for? Here’s a profile of the ideal Canadian reverse mortgage client:

- Age 55 or older: In Canada, individuals as young as 55 can qualify for a reverse mortgage. However, the older the borrower, the higher the percentage of home equity they can access.

- Homeowner: The client must own their primary residence, which should be their principal residence throughout the term of the reverse mortgage.

- Sufficient Home Equity: The ideal client has significant equity built up in their home, typically with minimal to no existing mortgage debt. The amount of equity will determine the maximum loan amount available through the reverse mortgage.

- Limited Income and Financial Flexibility: Canadian reverse mortgages are often sought by retirees or seniors with limited/fixed income who want to access the equity in their homes to supplement their retirement income, cover unexpected expenses (or live out their wildest dreams with their hard earned money!!!).

- Wants to maintain homeownership: Clients who wish to remain in their homes and maintain ownership while accessing their home equity are ideal candidates. They should have a strong desire to age in place.

- Understands the risks and benefits: The ideal client is well-informed about the terms, conditions, and implications of a reverse mortgage. They have received counseling from an accredited third-party counselor, as required by Canadian regulations.

- Needs flexibility in payment options: Canadian reverse mortgages offer flexibility in how funds are accessed, including lump-sum payments, periodic payments, or a combination of both. The ideal client chooses a payment plan that best suits their financial needs.

- No plans to move in the near future: Reverse mortgages are designed for individuals who plan to stay in their homes for at least 5 years or longer.

- Considers the impact on heirs: While the client may not have immediate plans to leave the home to heirs, they have considered and discussed with their family the potential impact of a reverse mortgage on inheritance and estate planning.

- Comfortable with interest accrual: Clients understand that interest accrues on the reverse mortgage balance over time, which can lead to a reduction in home equity over the loan term.

You can see now how a reverse mortgage unquestionably has a place in our market! There is no other way for retired homeowners to access the large amounts of equity in their homes to live out their retirements however they want. After working for 40+ years, we all deserve to live our best lives, don’t you agree?