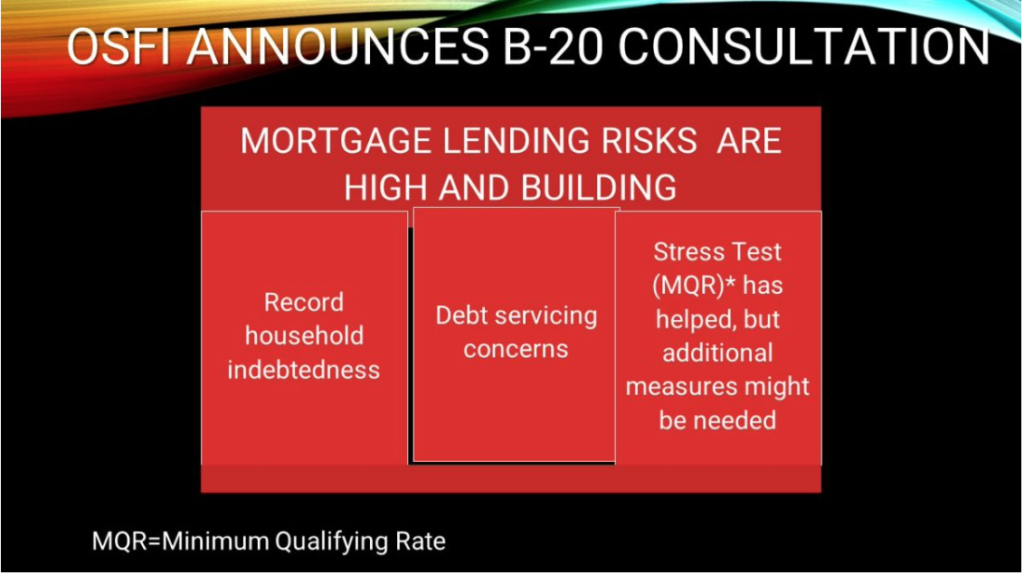

osfi is at it again.

Late last week, the Office of the Superintendent for Financial Institutions (OSFI) announced it was concerned about the risks associated with the large and rising number of highly indebted borrowers, especially those with floating-rate mortgages, which stands at a record proportion of outstanding mortgage loans.

With the economy in danger of entering a recession and the Bank of Canada warning of potentially more rate hikes to counter persistent inflation, the housing market may face continued pressure in the coming months.

A record number of buyers used floating-rate debt for purchases during Canada’s pandemic-era real estate boom. Those borrowers may come under increasing strain if mortgage costs remain high. Job losses from an economic slowdown also would make it harder for people to keep up with loan payments and stay in their homes.

Superintendent of Financial Institutions Peter Routledge said a review of the country’s mortgage-underwriting rules that starts later this week would look beyond its current main measure — a stress test requiring borrowers to qualify for higher interest rates than what their banks are offering.

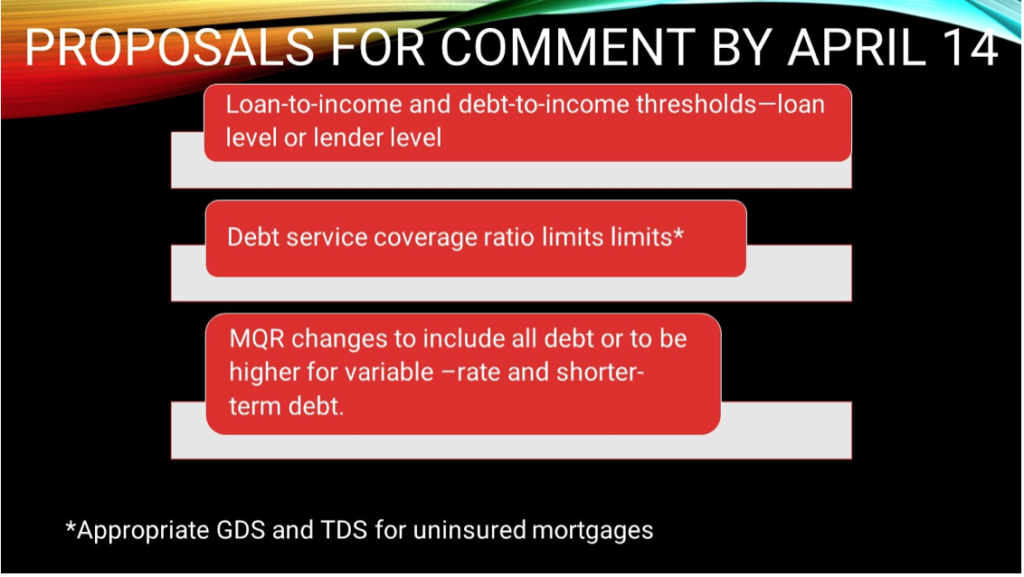

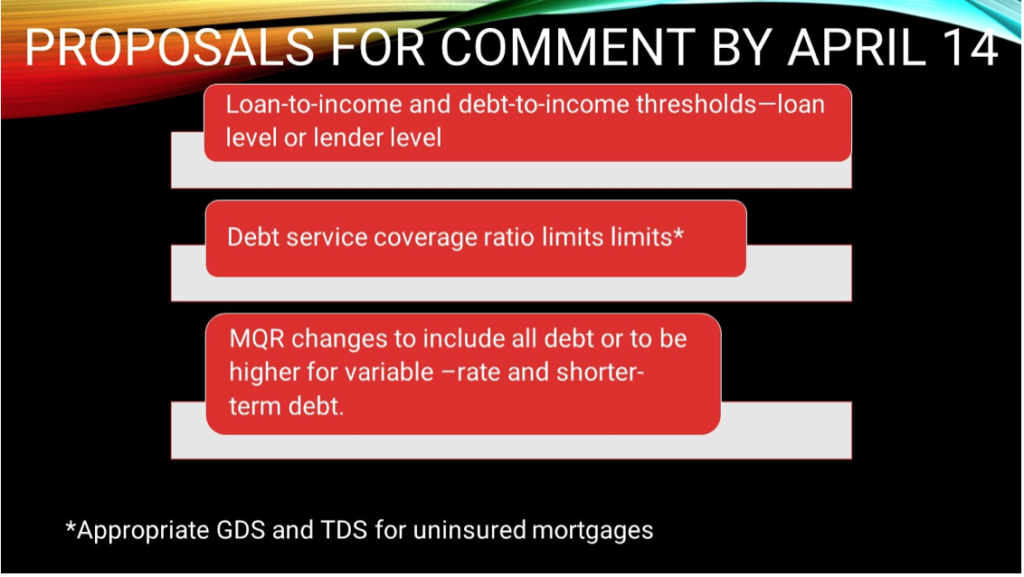

“The question in our minds is, is it sufficient?” Routledge said of the current stress test. “So we will look at a broader range of debt-serviceability tools, including debt-to-income constraints, debt-service constraints, as well as the current interest-rate stress test tool.”

The proposed rules—subject to public consultation—include loan-to-income and debt-to-income restrictions, new interest rate affordability stress tests and debt-service coverage restrictions.

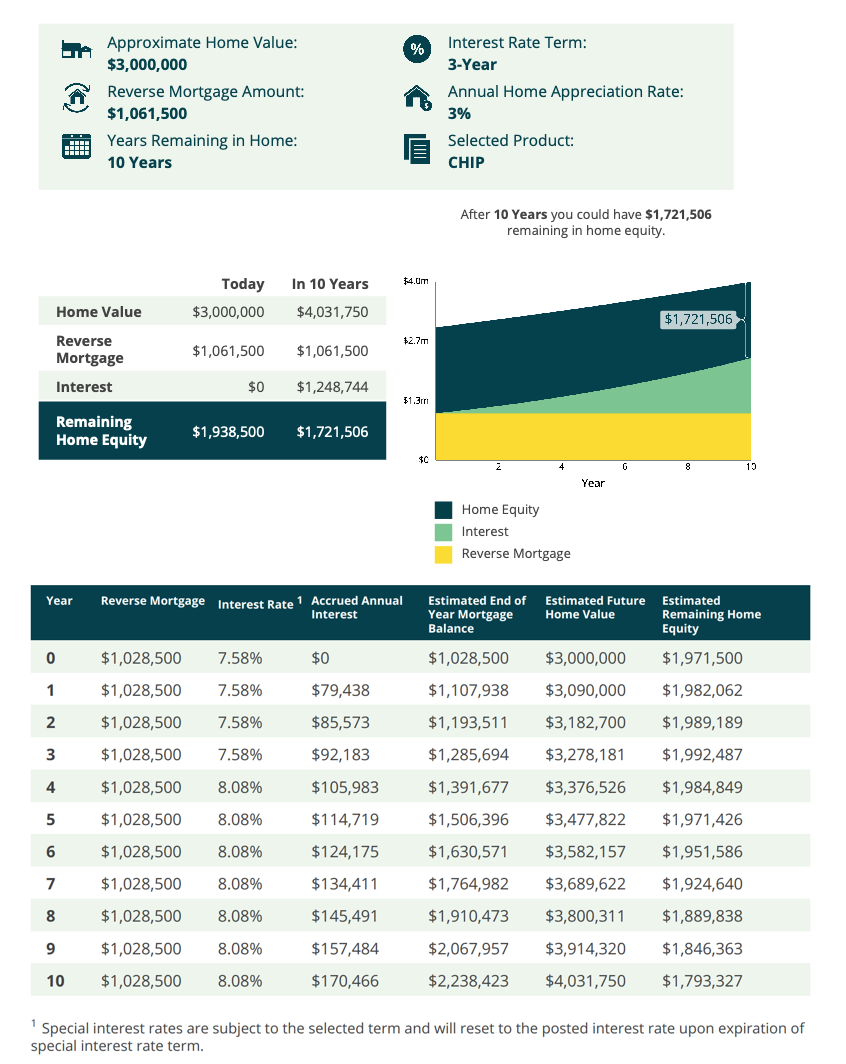

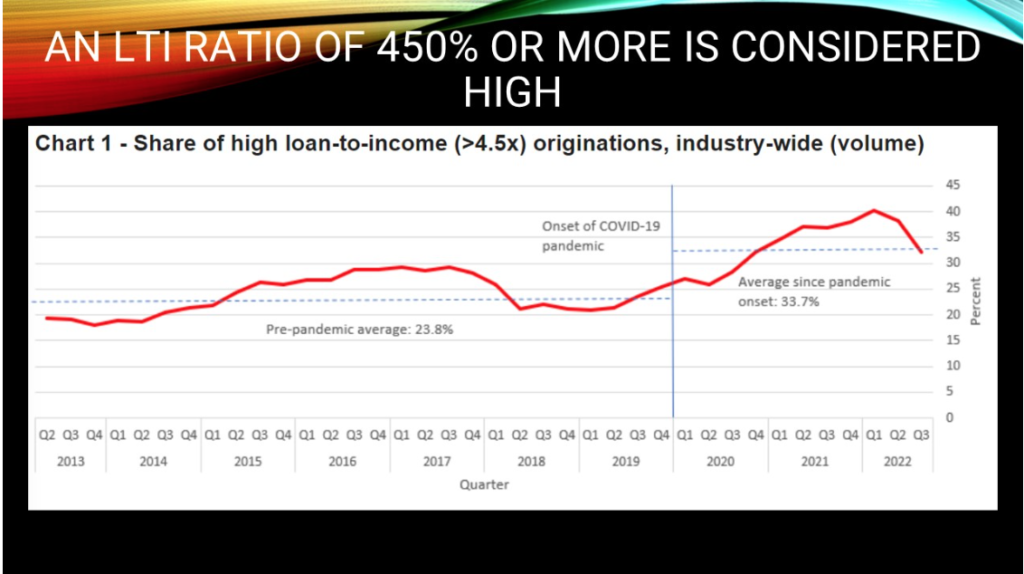

Highly Indebted Borrowers

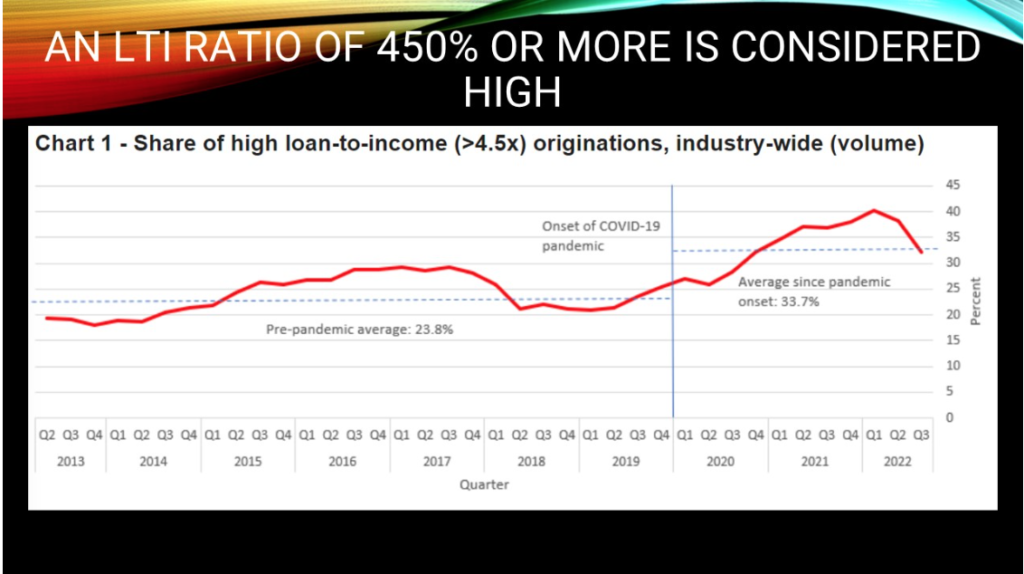

OSFI is particularly concerned about the rise in mortgage originations to households with a loan-to-income ratio of 450% or more, which the Bank of Canada has long asserted is the sector most at risk of delinquency and default. This risk has repeatedly been highlighted in the Bank’s financial risk analysis–the Governing Council’s Financial System Review. The latest report says, “Those with high debt are more vulnerable to a decline in income and will face more financial strain when they renew their mortgages at higher rates.”

This vulnerability relates to households’ ability to continue servicing their debt if incomes decline or interest rates rise without significantly reducing their consumption. The Bank staff estimate that the most highly indebted households have generally seen the smallest increases in liquid assets. At the same time, alongside higher house prices, many households have taken out sizable mortgages to purchase a house, adding to the already large share of highly indebted households.

The chart below shows that the average share of high loan-to-income borrowers before the pandemic was 23.8%. The average since the pandemic onset has risen to 33.7%.

Proposals for Comment

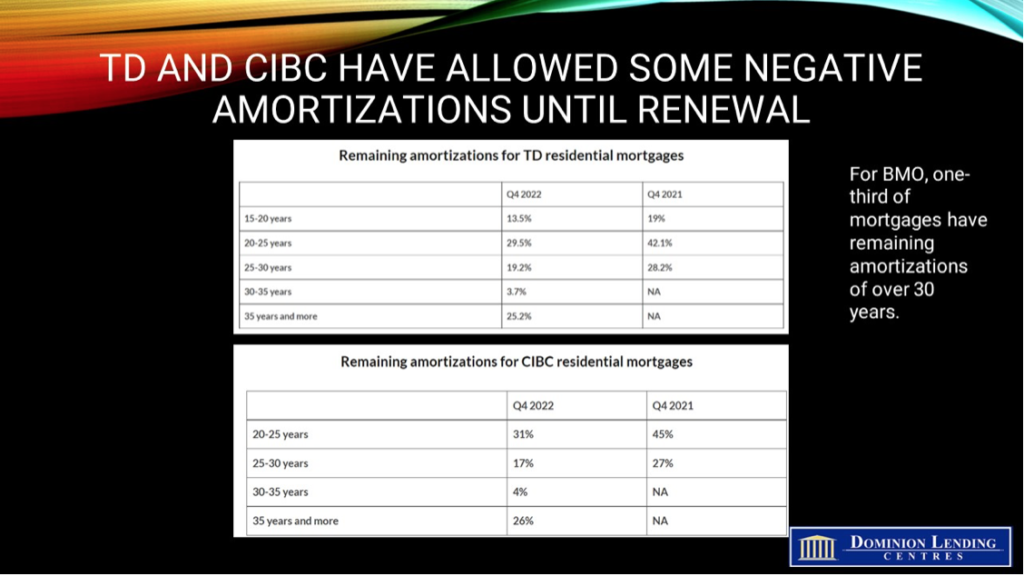

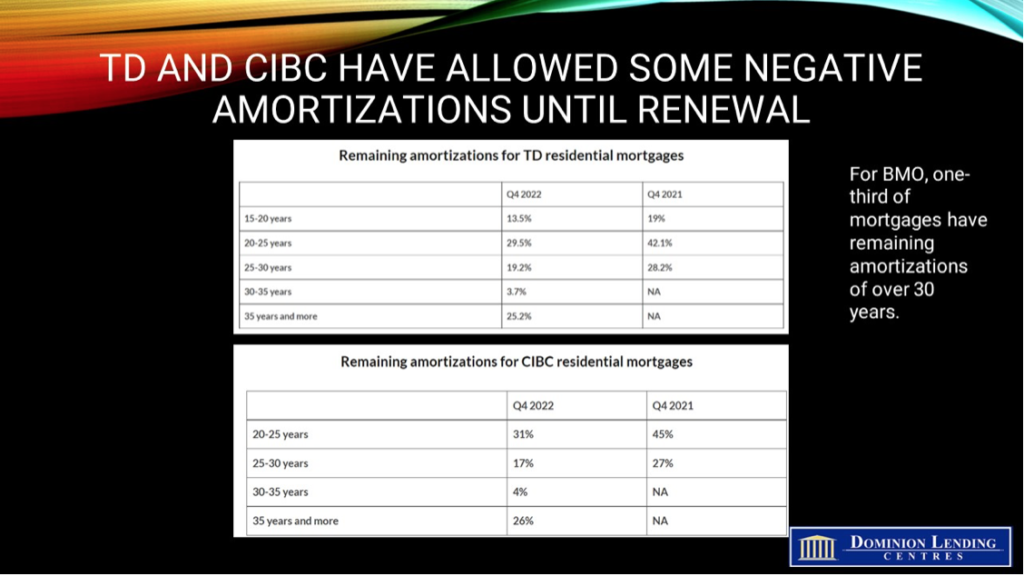

To date, mortgage delinquency rates at federally regulated financial institutions (FRFIs) are at a record low. The large FRFIs have worked closely with borrowers who have reached their trigger points. TD, CIBC, and BMO have allowed some negative amortizations until renewal. As a result, the proportion of their mortgages having remaining amortizations has risen sharply (see second chart below). Questions remain regarding how they will deal with this at renewal time. Will the new mortgage be amortized at 25 years at renewal, raising the monthly payments dramatically and increasing the risk of delinquency or default, especially among highly indebted households?

Earlier last week, CEOs of the Big 5 banks weighed in on vulnerable mortgage clients. None were quite as forthcoming as Scotiabank’s new President and CEO, Scott Thomson, who said the bank has about 20,000 borrowers that it considers “vulnerable.” These are borrowers with a high loan-to-value (LTV) mortgage, a low credit score, lower deposits in their checking accounts and those with home valuations that are susceptible to market conditions.

“So, as you think about the tail risk, we have about 20,000 vulnerable customers, which would be 2.5% [of the total portfolio],” he said Monday during the RBC Capital Markets Canadian Bank CEO Conference.

However, he added this represents a “manageable-type situation for us on mortgages.” Scotiabank’s floating-rate mortgages are not fixed payment. They adjust monthly payments every time the central bank changes the overnight rate.

According to Steve Huebl at Canadian Mortgage Trends, RBC President and CEO Dave McKay said that his bank is “keeping a watchful eye on its mortgage clients, turning to AI and various types of modelling to forecast clients’ cash flow.”

“We look at incomes, we look at the stress of inflation on expenses in a household, and we monitor cash flow to interest payments, as you would in any corporation,” McKay said during the conference. “We do that [for] every single consumer in our portfolio because over 80% of our clients have their core checking and core cash management with us.”

Looking at the bank’s variable-rate mortgage portfolio, which totals between $100 and $120 billion, McKay said the bank has been able to segment that group of clients, keeping tabs on when they reach their trigger rates and when they’ll be coming up for rate resets in the next several years.

Through modelling, the bank can then predict which clients with upcoming renewals “will or will not have a cash flow challenge” should the economy enter a moderate or severe recession, he said. “We have a pretty clear view of that.”

For clients who have difficulties making their payments, mortgage lenders have several options to try and assist borrowers before the situation progresses to the point of them needing to sell their homes.

“You have skip-a-payment deferrals, you have maturity extensions, whatever it happens to be, you have a lot of ways to work with that client,” McKay said.

In terms of clients with cash flow challenges in addition to a collateral problem, where the property sale wouldn’t cover their mortgage and could result in default, McKay said it’s a much smaller group but one the bank is actively monitoring.

“That bucket, I can tell you, is in the low single-digit percentages of our portfolio,” he said. “And that’s the bucket we’re managing.”

Bottom Line

To the extent these measures are implemented, further pressure on mortgage growth is likely. Mortgage brokers can access lenders not impacted by OSFI B-20 rule changes. More than ever, brokers could add value to borrowers turned away from the banks. In these uncertain times, existing and new clients need advice from a trained and caring professional.

Dr. Sherry Cooper

Chief Economist, Dominion Lending Centres

Yes, you may hold an FHSA as well as a TFSA or RRSP (or all three) at the same time.

Yes, you may hold an FHSA as well as a TFSA or RRSP (or all three) at the same time.

Here’s the reality folks….we are in unusual times and NO ONE definitively knows what to do! We can share what we learn from analysts and economists, factor in what projections the Bank of Canada has made and analyze your circumstances to assess what options might accommodate you best. But at the end of the day, you, as the consumer need to understand where you are at to determine where you want to go when you come to a crossroads. It’s way easier (and less stressful) to be proactive than reactive!

Here’s the reality folks….we are in unusual times and NO ONE definitively knows what to do! We can share what we learn from analysts and economists, factor in what projections the Bank of Canada has made and analyze your circumstances to assess what options might accommodate you best. But at the end of the day, you, as the consumer need to understand where you are at to determine where you want to go when you come to a crossroads. It’s way easier (and less stressful) to be proactive than reactive!