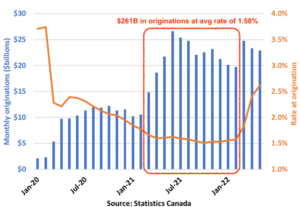

The last few years, we as a society have seen and endured many changes. And then those changes changed a few times too! As a result, there are so many unknowns out there…. From travel restrictions and requirements, to health policies and procedures to constantly shifting stock and financial markets. The only way to navigate life these days IS to ask questions, and and ask them often. Now more than ever, it is crucial for us as individuals to be our own advocates to ensure our physical and mental health, as well as our financial health. The glory days of being able to sit back and “let things ride” are no longer, as service providers, services and products are less easily available or accessible and those that are, are stretched thin. It’s much less stressful to be proactive than reactive, as the consequences of not asking questions in this economy could be harsh and long lasting. I’m no doctor or counsellor (although as a mom of 3, I often feel like it), but I can help you keep your financial health in order. Interest rates have risen so much that anyone in a variable rate mortgage absolutely MUST go to their lenders and ask some questions. You need to know what kind of mortgage you have, when your term ends, what your payments are, and how your trigger rate and trigger point are determined. If the answers to those questions leave you uncomfortable, worried or slightly queazy, you’re not alone. A recent Globe and Mail article noted, “Nearly three in every 10 homeowners with a mortgage had a variable interest rate at the end of 2021, according to the Bank of Canada. Of those, four out of five had fixed payments.”

The last few years, we as a society have seen and endured many changes. And then those changes changed a few times too! As a result, there are so many unknowns out there…. From travel restrictions and requirements, to health policies and procedures to constantly shifting stock and financial markets. The only way to navigate life these days IS to ask questions, and and ask them often. Now more than ever, it is crucial for us as individuals to be our own advocates to ensure our physical and mental health, as well as our financial health. The glory days of being able to sit back and “let things ride” are no longer, as service providers, services and products are less easily available or accessible and those that are, are stretched thin. It’s much less stressful to be proactive than reactive, as the consequences of not asking questions in this economy could be harsh and long lasting. I’m no doctor or counsellor (although as a mom of 3, I often feel like it), but I can help you keep your financial health in order. Interest rates have risen so much that anyone in a variable rate mortgage absolutely MUST go to their lenders and ask some questions. You need to know what kind of mortgage you have, when your term ends, what your payments are, and how your trigger rate and trigger point are determined. If the answers to those questions leave you uncomfortable, worried or slightly queazy, you’re not alone. A recent Globe and Mail article noted, “Nearly three in every 10 homeowners with a mortgage had a variable interest rate at the end of 2021, according to the Bank of Canada. Of those, four out of five had fixed payments.”Be Your Own Advocate!

General Darla Nicholson 5 Oct

The last few years, we as a society have seen and endured many changes. And then those changes changed a few times too! As a result, there are so many unknowns out there…. From travel restrictions and requirements, to health policies and procedures to constantly shifting stock and financial markets. The only way to navigate life these days IS to ask questions, and and ask them often. Now more than ever, it is crucial for us as individuals to be our own advocates to ensure our physical and mental health, as well as our financial health. The glory days of being able to sit back and “let things ride” are no longer, as service providers, services and products are less easily available or accessible and those that are, are stretched thin. It’s much less stressful to be proactive than reactive, as the consequences of not asking questions in this economy could be harsh and long lasting. I’m no doctor or counsellor (although as a mom of 3, I often feel like it), but I can help you keep your financial health in order. Interest rates have risen so much that anyone in a variable rate mortgage absolutely MUST go to their lenders and ask some questions. You need to know what kind of mortgage you have, when your term ends, what your payments are, and how your trigger rate and trigger point are determined. If the answers to those questions leave you uncomfortable, worried or slightly queazy, you’re not alone. A recent Globe and Mail article noted, “Nearly three in every 10 homeowners with a mortgage had a variable interest rate at the end of 2021, according to the Bank of Canada. Of those, four out of five had fixed payments.”

The last few years, we as a society have seen and endured many changes. And then those changes changed a few times too! As a result, there are so many unknowns out there…. From travel restrictions and requirements, to health policies and procedures to constantly shifting stock and financial markets. The only way to navigate life these days IS to ask questions, and and ask them often. Now more than ever, it is crucial for us as individuals to be our own advocates to ensure our physical and mental health, as well as our financial health. The glory days of being able to sit back and “let things ride” are no longer, as service providers, services and products are less easily available or accessible and those that are, are stretched thin. It’s much less stressful to be proactive than reactive, as the consequences of not asking questions in this economy could be harsh and long lasting. I’m no doctor or counsellor (although as a mom of 3, I often feel like it), but I can help you keep your financial health in order. Interest rates have risen so much that anyone in a variable rate mortgage absolutely MUST go to their lenders and ask some questions. You need to know what kind of mortgage you have, when your term ends, what your payments are, and how your trigger rate and trigger point are determined. If the answers to those questions leave you uncomfortable, worried or slightly queazy, you’re not alone. A recent Globe and Mail article noted, “Nearly three in every 10 homeowners with a mortgage had a variable interest rate at the end of 2021, according to the Bank of Canada. Of those, four out of five had fixed payments.”