Here’s the reality folks….we are in unusual times and NO ONE definitively knows what to do! We can share what we learn from analysts and economists, factor in what projections the Bank of Canada has made and analyze your circumstances to assess what options might accommodate you best. But at the end of the day, you, as the consumer need to understand where you are at to determine where you want to go when you come to a crossroads. It’s way easier (and less stressful) to be proactive than reactive!

Here’s the reality folks….we are in unusual times and NO ONE definitively knows what to do! We can share what we learn from analysts and economists, factor in what projections the Bank of Canada has made and analyze your circumstances to assess what options might accommodate you best. But at the end of the day, you, as the consumer need to understand where you are at to determine where you want to go when you come to a crossroads. It’s way easier (and less stressful) to be proactive than reactive!

Static variable mortgage vs non static variable mortgage (or adjustable rate mortgage)?

A static variable mortgage means your monthly payment stays the same despite interest rate increases, but the bank puts more of your money towards interest and less towards the principal. As a result the amortization of the mortgage increases. A non static variable mortgage means that the bank adjusts your payment to reflect the increased interest required by increased interest rates. As a result, amortization remains stable.

Trigger rate and trigger point?

If you hold a static variable rate mortgage, you need to know what these terms mean. You’ve reached the ‘Trigger Rate’ when the interest rate rises to the point that the entire fixed payment is 100% interest. You’ve hit the “Trigger Point” when your principal debt has crept back up to its original level, or higher as a result of making interest only payments for a long period.

OMG I have a variable rate mortgage, what do I do?

The good news is you have options. Everyone’s options will look different depending on what their circumstances are and what their capacity for payments is and what their risk tolerance is. A good mortgage broker will look closely at your entire financial landscape and see options outside the traditional boxed ones every broker is writing about.

I am in a fixed rate mortgage, none of this applies to me right?

(Cue buzzer sound) WRONG. If you’re a homeowner you will have to renew at some point. You should have a mortgage review done, re-visit your current budget (as everyone’s has changed post pandemic), and explore all the options available to you so you can be proactive and prepared so you can make education decisions with confidence (or at least some sense of faith).

Geez, what should I do?

Easy! 1. Check what mortgage product you are in. 2. If you are in a static variable mortgage ask how your lender manages trigger rate and trigger point. 3. Talk to a mortgage broker to assess your options. Your lender can only offer their own products and rates. I have access to 90+ lenders. It costs you ZERO to do a mortgage review and might save your family $000’s!

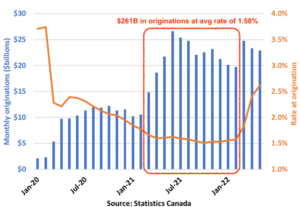

The last few years, we as a society have seen and endured many changes. And then those changes changed a few times too! As a result, there are so many unknowns out there…. From travel restrictions and requirements, to health policies and procedures to constantly shifting stock and financial markets. The only way to navigate life these days IS to ask questions, and and ask them often. Now more than ever, it is crucial for us as individuals to be our own advocates to ensure our physical and mental health, as well as our financial health. The glory days of being able to sit back and “let things ride” are no longer, as service providers, services and products are less easily available or accessible and those that are, are stretched thin. It’s much less stressful to be proactive than reactive, as the consequences of not asking questions in this economy could be harsh and long lasting. I’m no doctor or counsellor (although as a mom of 3, I often feel like it), but I can help you keep your financial health in order. Interest rates have risen so much that anyone in a variable rate mortgage absolutely MUST go to their lenders and ask some questions. You need to know what kind of mortgage you have, when your term ends, what your payments are, and how your trigger rate and trigger point are determined. If the answers to those questions leave you uncomfortable, worried or slightly queazy, you’re not alone. A recent Globe and Mail article noted, “Nearly three in every 10 homeowners with a mortgage had a variable interest rate at the end of 2021, according to the Bank of Canada. Of those, four out of five had fixed payments.”

The last few years, we as a society have seen and endured many changes. And then those changes changed a few times too! As a result, there are so many unknowns out there…. From travel restrictions and requirements, to health policies and procedures to constantly shifting stock and financial markets. The only way to navigate life these days IS to ask questions, and and ask them often. Now more than ever, it is crucial for us as individuals to be our own advocates to ensure our physical and mental health, as well as our financial health. The glory days of being able to sit back and “let things ride” are no longer, as service providers, services and products are less easily available or accessible and those that are, are stretched thin. It’s much less stressful to be proactive than reactive, as the consequences of not asking questions in this economy could be harsh and long lasting. I’m no doctor or counsellor (although as a mom of 3, I often feel like it), but I can help you keep your financial health in order. Interest rates have risen so much that anyone in a variable rate mortgage absolutely MUST go to their lenders and ask some questions. You need to know what kind of mortgage you have, when your term ends, what your payments are, and how your trigger rate and trigger point are determined. If the answers to those questions leave you uncomfortable, worried or slightly queazy, you’re not alone. A recent Globe and Mail article noted, “Nearly three in every 10 homeowners with a mortgage had a variable interest rate at the end of 2021, according to the Bank of Canada. Of those, four out of five had fixed payments.”